Impact of recent amendments to legislation and interest rate cycle. By Bernard Minnaar, Managing Director: Namib Bou

Overview of Legislative Changes

Overview of Legislative Changes

The Transfer Duty Act (2024) amendments, which primarily target residential property transactions, have increased the cost of transferring residential properties held in corporate entities by applying transfer duties to shares in companies and member interests in close corporations. These changes aim to close tax loopholes, making property transactions more transparent and taxable. Notably, transfer duty rates for lower-end properties have been reduced, which could encourage more activity in the affordable housing segment while maintaining increased costs for high-value and entity-held properties.

Interest Rate Cycle Shifts to a Downward Trend

Namibia, aligned with South Africa's monetary policy, has recently reached the top of its interest rate cycle. The Bank of Namibia has begun reducing rates in response to cooling inflation and to ease economic pressures, evidenced by a 25-basis point rate cut in October 2024. This shift is expected to lower borrowing costs, making mortgages more accessible and stimulating demand across market segments, particularly in middle-income housing where affordability constraints had previously limited ownership. As financing becomes more affordable, we expect a gradual transition from rental demand to ownership in specific market segments as prospective homeowners seize the opportunity to enter the market.

Impact on Property Values

The combination of the transfer duty amendments and interest rate shifts is expected to impact property values differently across market segments:

In the Luxury Housing Market (N$3 million and up), developments in Namibia's oil and gas sector may significantly boost demand for luxury properties, particularly as energy projects attract high-net-worth individuals and industry executives to Windhoek, Swakopmund, and Lüderitz. The amended transfer duties may deter short-term speculative activity but are unlikely to suppress the long-term demand growth driven by economic expansion in these areas.

As for the Middle-Income (N$1 million to N$3 million) and Affordable Housing (N$1 million and below), the middle-income housing market stands to benefit most from the easing interest rates, as lower borrowing costs enhance affordability. Additionally, the recent reduction in transfer duties for lower-end residential properties may further stimulate demand by enabling more first-time buyers to enter the market.

Similarly, in the Commercial and Industrial property segment, demand in the industrial and commercial segments, especially in Walvis Bay and Lüderitz, will remain robust due to ongoing developments in the energy sector (offshore oil, gas, and green hydrogen projects). With a decrease in borrowing costs, investment in logistics, warehousing, and industrial parks is expected to increase, particularly as Namibia positions itself as a regional hub for energy and trade.

Illustrative Table: Transaction Costs and Affordability

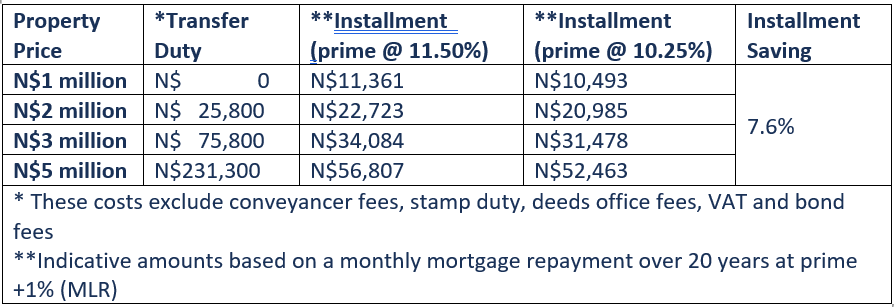

The table below outlines estimated transaction costs and monthly instalment amounts based on different property price categories at interest rates starting from the peak of 11.5%, reducing to 10.25% (forecasted to take place by mid-2025).

Outlook for Property as an Investment Class

As Namibia's interest rate cycle enters a period of stabilisation and gradual decline, the property is once again positioned as an attractive asset class for long-term investors. Key trends shaping the future of property investments include:

1. Shift to Long-Term Investment: With declining rates, the focus will likely shift from rental-driven strategies to ownership, particularly in the middle-income and affordable housing segments.

2. Rising Demand in Luxury Market: The oil-and-gas sector is anticipated to drive luxury property demand, particularly as Namibia's role in energy production expands.

3. Sustainability and Green Real Estate: Namibia's push toward green hydrogen and sustainable energy aligns with growing global interest in eco-friendly developments.

4. Stable and Attractive for Foreign Investment: Namibia's economic stability, resource wealth, and infrastructure advancements make it an attractive destination for international investors seeking stable, long-term returns.

Namibia's property market is entering a recovery phase, bolstered by reduced interest rates and selective legislative adjustments that favour affordable housing. While high-end speculative activity may slow due to transfer duty increases, the middle-income housing sector is expected to benefit from improved affordability, and the industrial sector remains robust due to Namibia's energy potential.

With a balanced approach focusing on long-term rental income, sustainability, and strategic ownership, investors are well-positioned to capitalise on Namibia's evolving property landscape. As Namibia strengthens its position as a regional hub for energy and sustainable development, the property market will continue offering diverse and resilient investment opportunities.